Cryptocurrency Assets : Consider the Capital Gains Tax Consequences

21 Feb '24

21 Feb '24

As commonly understood, Australia does not recognise Bitcoin or any other form of cryptocurrency as legal tender or currency (despite the name). So, if it isn’t currency, then what is it? This article explores how cryptocurrency is captured by definitions within the tax act and how crypto assets would be treated for tax purposes held on capital account.

Delving deeper into the capital gain tax (CGT) provisions, it is quite interesting to see how the ATO has defined assets that fall within its scope. These things called ‘CGT assets’ fall within these rules and accordingly are taxed as capital gains/losses.

Section 108-5 defines a CGT asset to be:

Broad, isn’t it? But let’s dive deep into this further.

Legally, the high courts have accepted that ‘property’ refers not to a thing but to a description of a legal relationship with a thing and, more specifically, to the degree of power that is recognised in law as permissibly exercised over the thing.

Further, there is no single test or factor for determining a proprietary right. The Ainsworth test is the authoritative source here, which refers to whether a right is:

In the case of crypto, these assets are treated as valuable, transferable items of property by a community of Crypto users and merchants. There is an active market for trade in crypto, and substantial amounts of money can change hands between transferors and transferees of the asset class.

Typically, the holdings rights also inhibit excludability because the software restricts control of a holding to the person possessing the private key. It is definable, identifiable, and sufficiently stable. Overall, the ATO views that the crypto is a CGT asset.

As noted above, with Crypto being a CGT asset, we must take note of certain taxable events. Transactions which may involve a taxing point (to name a few) include:

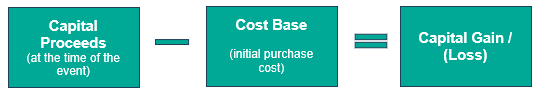

When a taxable event (called a CGT event) occurs, you are required to calculate a capital gain (or loss) on the cryptocurrency by reference

to:

If there is a resulting capital gain on disposal of the crypto asset (meaning you sold the crypto asset for more than you bought it for),

this is reported on your tax return (or whichever entity made the capital gain). If you have held the asset for more than 12 months as an

individual, then you are eligible to apply the 50% CGT general discount on the gross capital gain.

There is often a fallacy that there is a separate CGT rate of tax for capital gains. This is not the case. The reportable capital gain is included with our other reportable income. Tax is paid at a marginal tax rate based on what your total taxable income is for that year.

On the other hand, if the cost base exceeds the proceeds received, then you make a capital loss on disposal. Unfortunately, the capital loss will need to be quarantined and carried forward to offset against capital gains you make in future years (crypto or other assets).

Whilst the CGT regime that applies to cryptocurrency in Australia is often quite ridged because the crypto assets are ‘fungible’ (which means that they are identical and interchangeable with one another), it is quite hard to tell which order we need to apply the cost base to calculate the capital gain.

There are 3 common ways for ordering and calculating parcels matches for CGT on crypto:

First in First out (FIFO) – where the cryptocurrencies bought first are sold first, regardless of the value of the cost

Last in First out (LIFO) – where the cryptocurrencies bought last are sold first, regardless of the value of the cost

Highest in First out (HIFO) – where the most expensive cryptocurrencies bought are sold first, regardless of timing

While simplistic, the difference in the capital gains tax payable can be huge. For example, if you recently bought and the market turned bearish, you would apply the LIFO method to capture a capital loss rather than the FIFO method when the parcel cost was lower.

Alternatively, in a bull market, say you bought a bag of crypto assets and sold 2 days later, you could apply a longer term crypto to take advantage of the CGT general 50% discount to reduce your overall taxes.

Want to ensure you get the most out of your crypto taxes?

Let Consensus Layer be your trusted crypto accountants in helping you bridge the gap between the ATO’s complex world and the new digital financial frontier.

Contact us today on (07) 3569 3703 to discuss your specific needs and discover how we can help you optimise your tax outcomes and ensure compliance in the ever-evolving world of cryptocurrencies.

We send tailored updates straight from our team of specialists to your inbox.